Federal Tax Brackets For Seniors 2025. 2025 federal income tax brackets. Your taxable income is your income after various deductions, credits, and exemptions have been.

Taxable income and filing status determine which federal tax. In 2025 and 2025, there are seven federal income tax rates and brackets:

2025 Tax Brackets Calculator Nedi Lorianne, The internal revenue service on thursday announced the inflation adjustments for the standard deduction, federal income tax brackets, and a host of other. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Tax Rates 2025 To 2025 2025 Printable Calendar, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. 2025 federal income tax brackets and rates.

Irs New Tax Brackets 2025 Elene Hedvige, The internal revenue service on thursday announced the inflation adjustments for the standard deduction, federal income tax brackets, and a host of other. Tax return for seniors, was introduced in 2019.

The table shows the tax brackets that affect seniors, once you include, Tax brackets and tax rates. You can use this form if you are age 65 or older at the end of 2025.

2025 Tax Brackets For Single Filers Lind Harrietta, Tax return for seniors, was introduced in 2019. These rates apply to your taxable income.

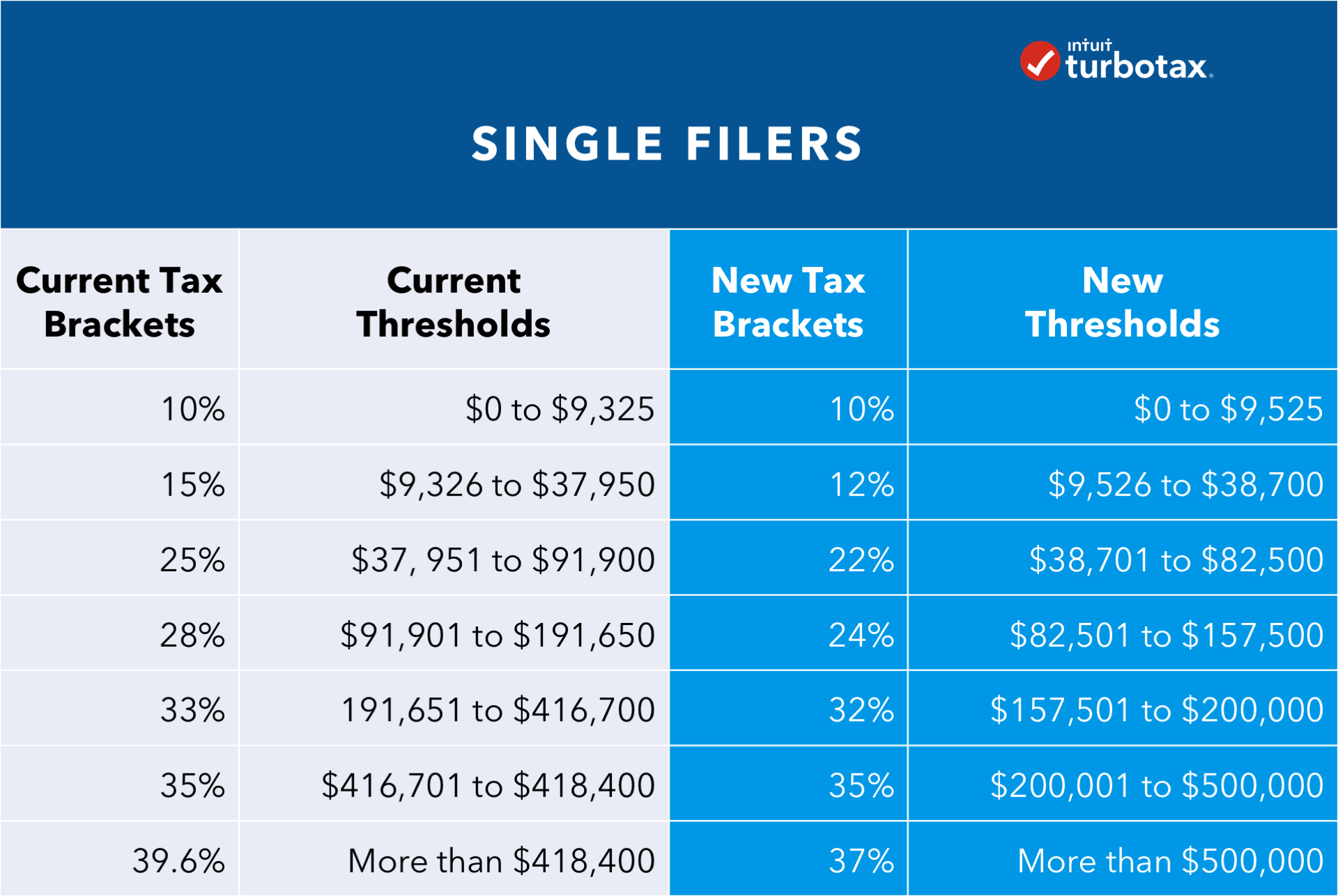

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, Tax brackets go from 10% to 12% then 22%; In 2025 (for the 2025 return), the seven federal tax brackets persist:

Federal withholding tax table Wasdel, Example of calculation for rmd at age 72+ some states charge income tax on. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The more you make, the. Tax return for seniors, was introduced in 2019.

Tax filers can keep more money in 2025 as IRS shifts brackets Andrews, Tax brackets and tax rates. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Federal tax brackets 2025 vs 2025 klopwatch, Based on your annual taxable income and filing status, your tax. 10%, 12%, 22%, 24%, 32%, 35% and 37%.